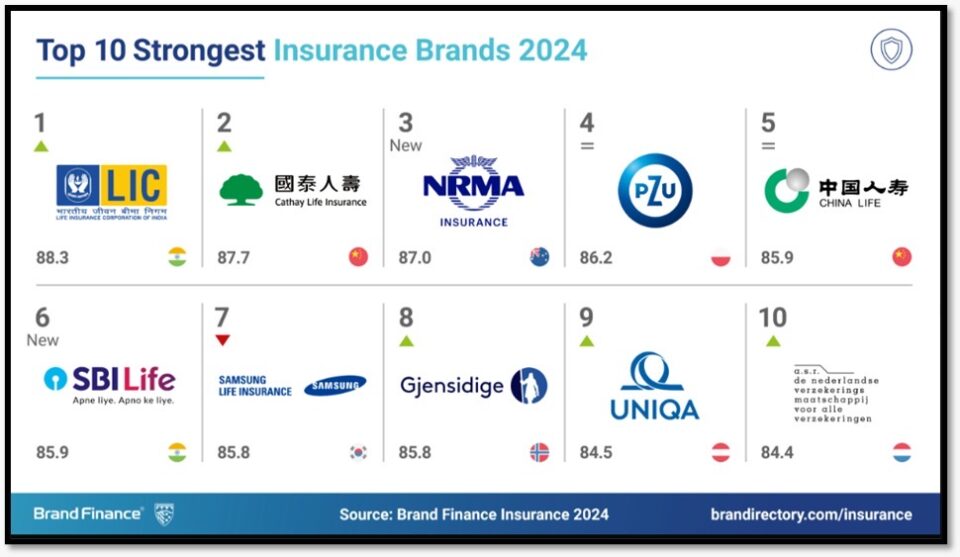

Public sector behemoth Life Insurance Corporation of India is the strongest insurance brand, as per a report released by Brand Finance Insurance 100 2024. The report notes that LIC’s brand value remains steady at USD 9.8 billion, accompanied by a brand strength index score of 88.3 and an associated AAA brand strength rating.

Following LIC, the rankings highlight Cathay Life Insurance as the second strongest brand, experiencing a 9% increase in brand value to USD4.9 billion, closely followed by NRMA Insurance, which saw an 82% rise in brand value to USD1.3 billion.

Notably, Chinese insurance brands maintain dominance in the global rankings, with Ping Anleading with a 4% increase in brand value to USD33.6 billion, followed by China Life Insurance and CPIC defending their 3rd and 5th positions, respectively. Allianz from Germany and AXA from France retain their spots in the 2nd and 4th positions to complete the Top 5.

Among the brands experiencing significant growth in brand value, NRMA Insurance from Australia stands out with an 82% increase to USD1.3 billion, along with Denmark’s Tryg, which saw a 66% rise to USD1.6 billion.

Additionally, LIC India achieved the highest first-year premium collection of Rs. 39,090 crore in FY 2023, while SBI Life Insurance and HDFC Life Insurance led the private sector with new business premium collections of Rs. 15,197 crore and Rs. 10,970 crore, respectively.

In recent developments, the government approved a 17% wage revision for LIC employees, effective from August 2022, benefiting over 110,000 employees. LIC’s shares also reached an all-time high of Rs 1175, making it India’s most valuable PSU company and reclaiming its status as the fifth most valuable Indian listed company, surpassing SBI in market valuation.